Many traders use Pair trading in trading, and on any markets and exchanges (MOEX-Moscow Exchange, Forex, Cryptocurrency, American market). Let’s talk in this article about the use of pair trading for the cryptocurrency market.

Let’s first find out the difference between pair trading and arbitrage strategy. The main difference is as follows: in arbitrage, you are trading the same instrument. But on different exchanges, or, for example, futures on the same asset, but with a different expiration date.

Deviations in the value of assets diverge and always converge. When trading pair trading, you use tools with a large correlation between each other. That is, assets that depend on each other fundamentally. They are generally the same in their behavior, but sometimes one goes faster, sometimes the other. Or they may be multidirectional at some point. But then the directions still coincide.

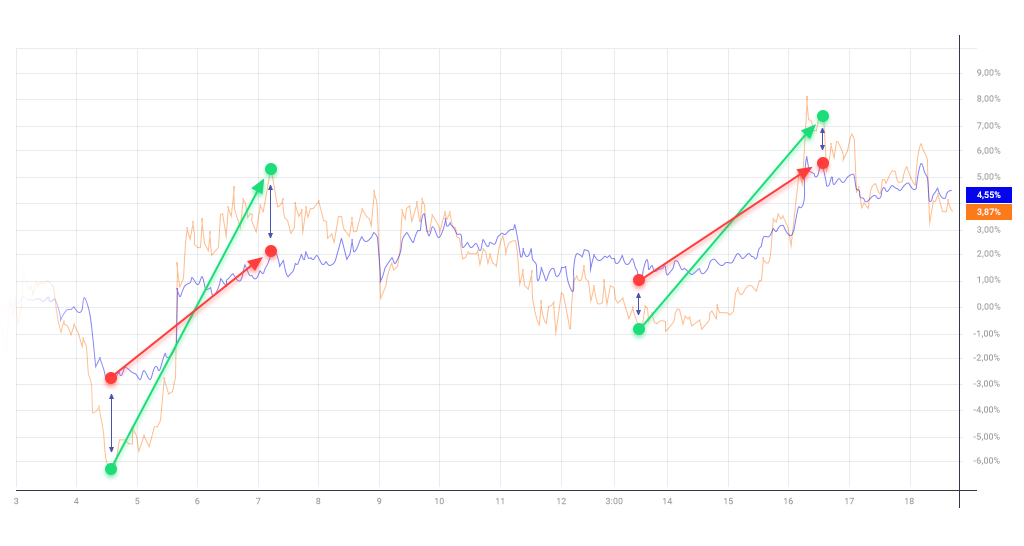

Let’s analyze two cryptocurrency pairs ETHUSDT and BTCUSDT for clarity. These pairs have different assets — BTC and ETH. At the same time, they are united by a fiat currency — USD, which gives a similar dependence in the behavior of both pairs, and as a result, a correlation between them.

The screenshot above shows the trades on the pair trading strategy. When a certain delta diverges between the instruments, we buy one pair (which is cheaper), and sell the second pair (which is more expensive). When the pairs converge, we close both trades. This is what trading looks like in general terms. And yet, many cryptocurrency pairs are correlated with each other due to the fact that there are fiat currencies (USD, EUR) in the pair.

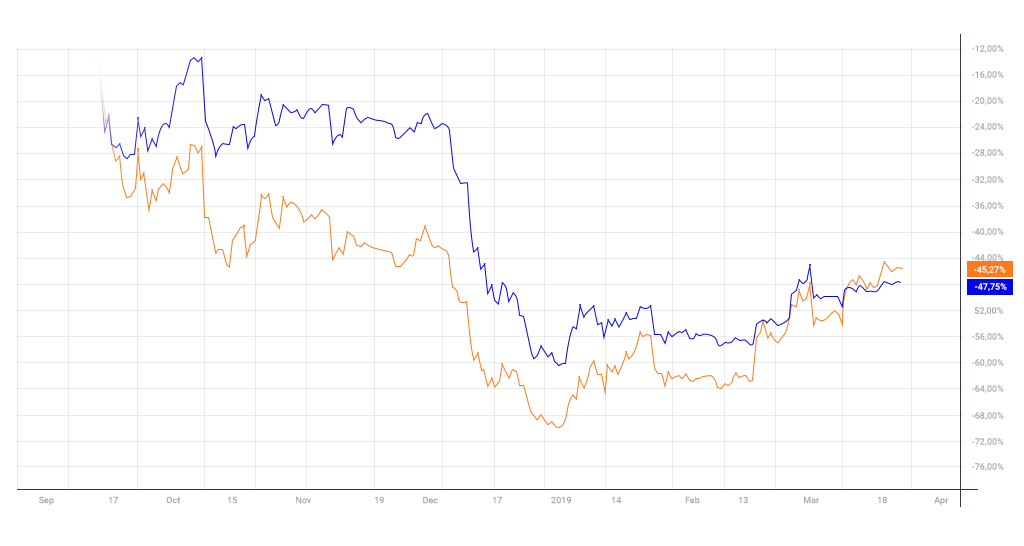

The fact that there is a correlation between the pairs is very good. And it suits us. But, unfortunately, the exchange rate of cryptocurrencies sometimes does not converge after, and may continue to diverge further.

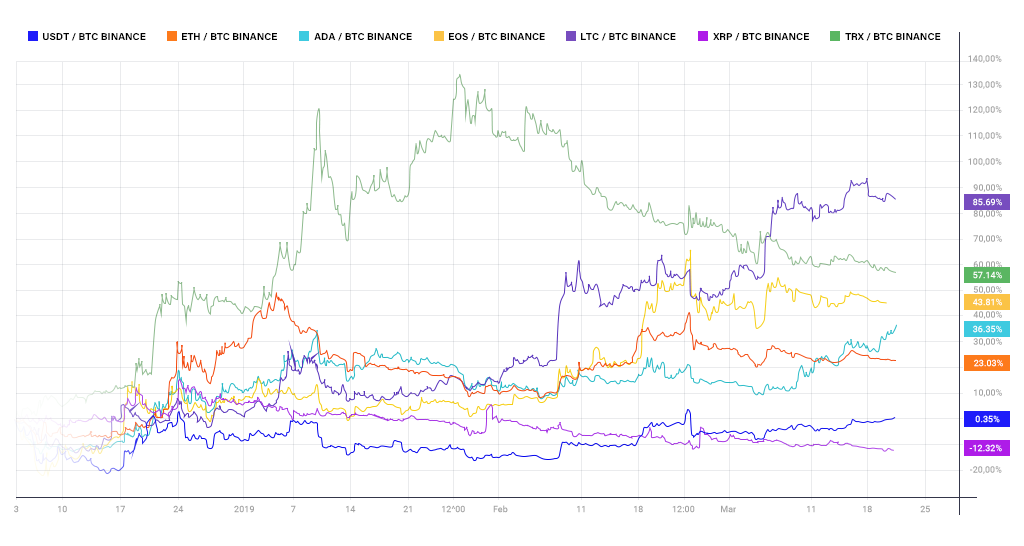

The picture above shows that even if there is a correlation between the pairs, each currency has its own chart behavior. And what do we do about it now? Accept and use the fact that there may be large discrepancies at times and you can use it too. However, for the successful use of pair trading, it is simply necessary that the pairs converge. How to solve this problem?

To build a clear model for trading the correlation between the instruments, we need to build a delta-the difference between the instruments. To construct a delta, you can subtract the cost of one from the cost of the second. And you can divide the value of one asset by the value of the second. This will give us the opportunity to build a dynamic delta. We will also work with the relative prices of instruments.

For example, take the average of the difference in the prices of instruments. All the same, there will be an impact of price movement and transactions on the strategy may close in the negative. This will happen at the expense of multidirectional transactions on correlated instruments, the minus will be controlled and at least not afraid of a market crash. Since the loss on one pair will be compensated by the profit on the second pair.

To trade pair trading, you need to use at least two tools. But in order to create a diversification of our trade and increase the correlation, you can try to trade two pairs against two pairs. For example, you can use not just BTCUSDT and ETHUSDT, but you can add a couple more tools to this design and get this scheme: BTCUSDT+ESOUSDT against ETHUSDT+LTCUSDT (the volume for each pair can be aligned taking into account the exchange rate or taking into account their volatility), you can also not stop there and trade three pairs against three, etc.

According to the graph, it is noticeable that when adding additional pairs, we have a better convergence, because by adding pairs, we smooth out the individual character of each pair and get the result of trading two synthetic instruments. In simple terms, this type of pair trading is called Basket trading or currency basket trading. So what are the benefits of trading pair trading and what are the negative aspects?

Pros:

Such a strategy can already be formalized and fully tested and automated. Manual trading this approach with a large number of instruments is theoretically possible, in practice we will have completely different results due to the delay in transactions or their skipping.

Pair trading you can trade on futures instruments, so that you can open not only purchases, but also sales.

According to the strategy, we always have protection for the overall position, because the transactions are multidirectional, so we can use the leverage, thereby increasing profitability.

A very capital-intensive strategy due to the use of a large number of highly liquid instruments.

Cons:

Only one — as in other strategies, there are negative trades. But with the right choice of pairs and settings, the mathematical expectation is on our side.

So we figured out what Pair Trading is and how to use it in the cryptocurrency market.

Jeremy Stone Cryptocurrency Read 7min

Jeremy Stone Investments Read 11min

Jeremy Stone Cryptocurrency Read 8min

Jeremy Stone Cryptocurrency Read 5min

Musqogees Tech Limited 41, Propylaion street RITA COURT 50 4th Floor, Off.401 1048 Nicosia, Cyprus

+357 95 910654

info@musqogee.com