Diversification will help to reduce losses when some shares and assets fall, and benefit from different instruments.

Diversification is a broad term. For example, it may mean expanding the range of products and services, developing new industries for the company to increase production efficiency and benefit. In this text we will discuss diversification in investments.

Investment diversification is the allocation of funds in a portfolio between different asset groups (shares, bonds and other instruments) in order to reduce risks.

An investment portfolio is a set of assets that have been collected in such a way that the income from them corresponds to the investor goals. It can include any assets that generate income. These are not only stock market instruments — shares, bonds, shares of exchange-traded funds, options, futures. Precious metals, currencies of different countries, bank deposits and real estate can be included in the portfolio.

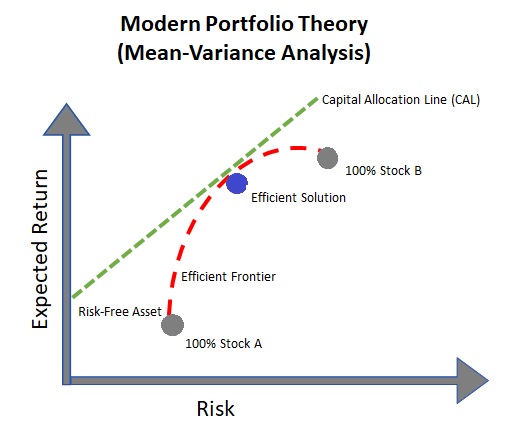

Modern portfolio theory is a method of asset selection, the purpose of which is to get maximum income with minimal risk. The American economist, Nobel Prize winner Harry Markowitz is at its origins. In 1952, he published an article “Portfolio Selection”.

Modern Portfolio Theory

To get a higher income, you need to choose investments with more risk. Their cost can both rise and fall sharply. However, you may not want to invest in such securities. It all depends on how much risk you are ready to take.

According to modern portfolio theory, risk can be managed through diversification. In case high-risk asset types are combined with others, you will get a balanced portfolio. The overall risk will be lower than that of individual instruments. For example, instead of buying only shares, you can combine them with bonds.

The theory proposes that it is necessary to select assets that have little or no correlation with each other, i.e., they behave differently in the same situation. Let us assume that the price of some securities increases with the increase in oil prices, while others, on the contrary, fall. So an investor can protect himself from market volatility and significant losses, because the profit under one security will compensate for the loss under the other.

Rebalancing the portfolio will help to maintain the level of risk speaking long-term. For example, initially, the shares by value occupied 70% in your portfolio, and bonds – 30%. But the cost of some shares has increased, and now they occupy 80%, and debt securities – 20%. To return the portfolio to its original state, you need to rebalance it. For example, sell some of the shares which cost has increased and reinvest the funds received, or buy bonds.

Harry Markowitz

A good portfolio is more than a long list of good stocks and bonds. It is a balanced whole, providing the investor with protections and opportunities with respect to a wide range of contingencies.

You should diversify your portfolio by assets so that during periods of stagnation or economic decline, your portfolio does not sink too much. Shares, bonds, deposits, funds are the main tools that will suit those who are familiar with the stock market for a relatively short period of time. You will be able to figure them out quickly enough to earn, and not to lose money.

You can also note contracts for the supply of goods, i.e. futures. However, this is already a more risky and unpredictable tool that will suit more experienced investors. If you do not understand how the tool works, it is better not to invest in it.

Shares are the most profitable part of the portfolio. Income from shares is received in two ways – in the form of dividends and due to price growth. Shares will rise when the economy grows, especially after the global financial crisis. When the whole market is falling, you can buy a lot of good companies at a reduced price. But you need to be careful and confident in the company’s business before buying its securities.

The main thing here is to avoid the temptation to buy third-tier shares at a steal, the quotations of which have decreased in price several times, but at the same time the debt burden is growing every year, financial stability raises big questions, and shareholders do not even know what dividends are. Greed in this case will never go down good.

Funds (ETF) are profitability and moderate risk. If you don’t want or don’t have time to deal with the business of each particular company, then you can invest in funds or an index. ETF includes several companies from the same industry at once. And when you buy a share in the fund, you buy as though several companies at once. Unlike the fund, you will not be able to buy a piece of the index. Because the index only monitors the behaviour of securities. But you can buy ETF that includes companies from the index.

At such a time, bonds will be just right. They will bring a stable income. Deposits can also be used in this case. However, they often have yields lower than bonds. Both of these instruments are conservative and will not bring such large income as shares. But they will help to protect your portfolio from strong volatility.

Bonds are not completely homogeneous, including in terms of their protective properties. They can be state, corporate and municipal. State ones are issued by the Ministry of Finance, municipal – by regions, corporate – by companies. The most reliable of all is the Ministry of Finance, because the bankruptcy of an entire country is less likely than of individual regions or companies.

Every investor should have bonds: “Bonds must be in the portfolio. And not high-risk, but strong corporate bonds, government bonds.

You can calculate in different ways how much of the bonds you should have in the portfolio. First of all, it depends on how ready you are for risk. If you want to minimize it, it is better to have about 50% of the bonds in your portfolio. You can also proceed from age. For example, if you are 30 years old, then there should be 30% of bonds in the portfolio, if you are 50 years old, respectively, 50% of bonds. Which way to choose is up to you.

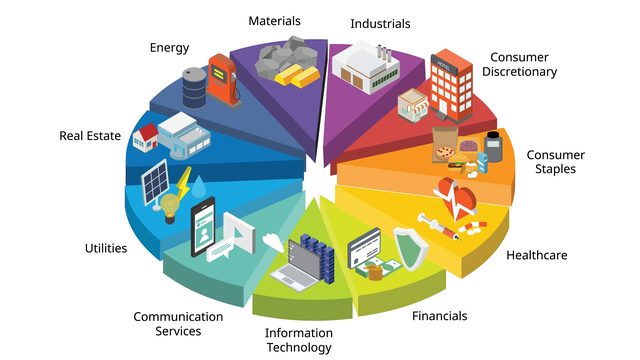

Market Sectors

In addition to diversification by assets, it is also important to distribute the portfolio by sectors or industries of the economy. The current crisis well shows again why this is important. When some shares fall, others rise on the contrary. This will create a balance in your portfolio and allow you to lose as little profitability as possible or not lose it at all.

Due to the pandemic, quarantine and closed borders, oil and gas companies together with the aviation industry have suffered greatly. But the shares of agro-industrial enterprises, petrochemicals and retail have risen on the contrary. Imagine that in January 2020 there were only aviation and oil companies in your portfolio. 50% of American Airlines Group and 50% of ExxonMobil. In this case, in March, your portfolio would have collapsed and suffered greatly, even despite the dividend payments of these companies. In addition, some companies temporarily refused to pay dividends due to financial difficulties.

And the following main industries in the economy can be distinguished on the stock market: oil and gas, telecommunications, petrochemicals, electric power, IT sector, metallurgy, pharmaceuticals, finance and banks, mining, retail, construction sector, transport. The latter industry can be divided into motor manufacturers, airlines and maritime transportation.

It is not necessary to invest in all industries at once. Choose the ones you like the most. Or those industries in which you are best versed and understand how the business of companies works. You can also look at the macroeconomic indicators in a particular country or in the world. When you have already decided on the instruments in which you plan to invest, start looking for securities in different sectors.

Many experienced investors advise to assemble a portfolio from different sectors gradually. They recommend to find the most promising shares of companies in each industry from an investment point of view, and gradually fill the portfolio with these securities. It is better to choose from one to three best representatives from each sector.

It is up to you how you will choose and conduct a comparative analysis among specific companies. “Someone will need financial multipliers and various analytical tools such as PairsTrade.pro, for others the discounted cash flow method will be suitable, conservatively minded long-term investors may limit themselves to the forecast of future dividends.

Here we come to the moment of country diversification. “If you are a starting investor, then at first you can and should concentrate only on the stock market. And when your account grows sufficiently, you will realize yourself which markets are worthy of your attention and bring the best results.

But if you invest in the instruments of only one country, then the political and economic risks for your securities increase. Especially if you are aiming at long-term investments. Pay attention to the international investment rating of countries, transparency of information on instruments and how developed and reliable financial institutions are.

STOCK SPLIT

Assets in a successful portfolio should be distributed so that it can withstand any economic storm and ensure stable profits speaking long-term. An example of a diversified portfolio is a simplified copy of the all-season portfolio of the famous investor Ray Dalio:

A legendary investor Warren Buffett invented the investment strategy “90/10” to invest his wife’s retirement savings. 90% of such a portfolio with such a strategy consists of ETF with a low commission and 10% of short-term government bonds.

The essence of the approach is simple: we have a fully secured position on futures and we put the money that is not blocked by the guarantee into bonds with a high level of reliability.

Also, one of the safest strategies is pair trading, i.e. hedging risks by identifying cointegrated pairs of shares and opening positions at the time of their strong divergence.

Jeremy Stone Cryptocurrency Read 7min

Jeremy Stone Investments Read 11min

Jeremy Stone Cryptocurrency Read 8min

Jeremy Stone Cryptocurrency Read 5min

Musqogees Tech Limited 41, Propylaion street RITA COURT 50 4th Floor, Off.401 1048 Nicosia, Cyprus

+357 95 910654

info@musqogee.com